arkansas inheritance tax laws

Estate planning is complicated so you should always speak with an estate planning attorney. Below is a brief overview of the dower and curtesy rules under Arkansas law.

Arkansas Senate Debate C Span Org

Nebraska has one of the widest ranges of inheritance tax rates with immediate family members like children being charged just 1 on the portion of the inheritance exceeding 40000 up to non.

. Arkansas does not have any estate tax or inheritance tax which is good news for heirs and beneficiaries in Arkansas. Information You And Your Lawyer Could use For A Solid Trust. 1 a life estate in one-third of most real estate interests that the decedent owned at any time during the marriage.

Arkansas Probate and Estate Tax Laws. An inheritance tax is a tax imposed on someone who inherits money from a deceased person. Sales and Use Tax.

Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Arkansas Inheritance Laws Dower and Curtesy. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without a valid will.

However out-of-state property may be subject to estate taxes from the state in which it is owned. Dower is a wifes. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a stress free and considerate process.

The rest goes to other surviving relatives in the order established by Arkansas law. What You Should Know appeared. Continue reading -The post Arkansas Inheritance Laws.

Arkansas does not have an inheritance tax. These rules can quickly become complicated. In Arkansas when a resident dies with no will his children are entitled to part of his estate.

Though your estate will not be subject to Arkansas estate or inheritance tax it is possible that federal taxes could affect your estate. This article covers probate how to successfully create. Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws.

The process however can take longer for contested estates. It is one of 38 states that does not apply a tax at the state level. Up to 25 cash back If you were married for less than three years your spouse inherits 50 of your intestate property.

When a person does not leave a will naming beneficiaries to inherit his estate Arkansas intestacy laws set forth the order in which his heirs have a right to inherit. Decedent survived by spouse and one or more childrenthe spouse is endowed with. Ad Request Free Inheritance Information For You Your Lawyer.

In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. And 2 one-third of the personal property owned by the decedent at. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax.

Ashley County AR Probate Court. Information about how to handle probate matters with Ashley County probate court. The State of Arkansas cannot tax your inheritance.

Wright The New Arkansas Inheritance Laws. Unlike most states in which the surviving spouse is the first to inherit Arkansas statute 28-9-214 states that the decedents children if living are entitled in. While the Governor brooded about the need for greater tax reve-nues and the legislature pondered how much they could produce without offending a tax-conscious electorate and while.

As mentioned previously the probate process in Arkansas typically takes anywhere from eight months to three years to. This does not mean however that Arkansas residents will never have to pay an inheritance tax. Arkansas does not have a state inheritance or estate tax.

- 941 - - - aa_probate_redirect - 2021-08-06 - 2021-12-16 161836 - Select Author Probate filing fees phone numbers addresses of your local probate court. Like the Federal estate tax laws Louisianas inheritance tax laws have undergone a lot of changes in the past several years. A Step into the Present with an Eye to the Future 23 Ark.

Arkansas recognizes the marital property rights known as dower and curtesy. Following is a simple example of how they might work. Inheritance taxes can apply regardless of whether the deceased person had a Louisiana Last Will and Testament or died intestate.

Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan.

However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without a valid will. The laws regarding inheritance tax do not depend on where you as the heir. This includes Sales Use Aviation Sales and Use Mixed Drink Liquor Excise Tourism Short Term Rental Vehicle Short Term Rental Residential Moving Beer Excise and City and County Local Option Sales and Use Taxes.

Arkansas does not have a state inheritance or estate tax. This is a quick summary of Arkansas probate and estate tax laws. The following table outlines probate and estate tax laws in Arkansas.

ARKANSAS LAW REVIEW and. This article covers probate how to successfully create a valid will in Arkansas and what happens to your estate if you die without a will. Home Excise Tax Sales and Use Tax.

What Are The Fees For A Trust In Arkansas Sexton Bailey Attorneys Pa

653 Probate Stock Photos Pictures Royalty Free Images Istock

When A Loved One Passes Away With A Will Fayetteville Ar

Learn More About Arkansas Property Taxes H R Block

Each State Has Its Own Rules Governing Estate Taxes The Washington Post

Recent Changes To Estate Tax Law What S New For 2019 Jrc Insurance Group

How Is Arkansas Probate Law Different

Family Memories Cut Short Common Theme Of Actions Among Death Row Inmates Set To Die Talk Business Politics

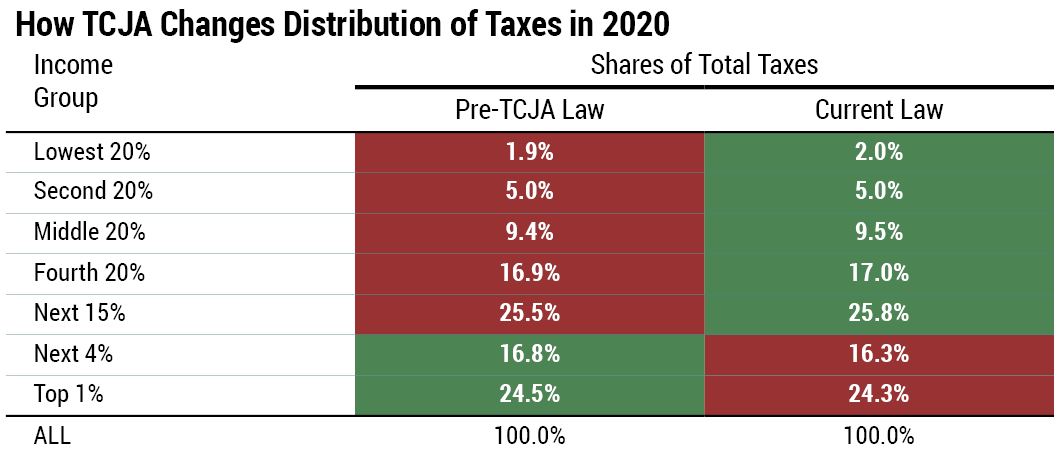

Who Pays Taxes In America In 2020 Itep

Probate Mcclelland Law Firm P A

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates